What is Virtual PPA? – A simple explanation of how it works and what benefits it brings to companies

Virtual Power Purchase Agreements (Virtual PPAs) are rapidly gaining ground as a contemporary method for businesses to engage in environmental value trading.

Through the introduction of Virtual PPAs, companies can effectively reduce their CO2 emissions. This article aims to provide a clear explanation of the fundamental structure and key advantages of Virtual PPAs.

目次

What is a Virtual PPA?

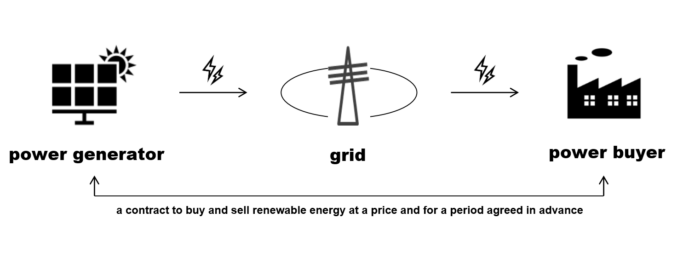

PPA is an abbreviation for “Power Purchase Agreement”. Under a PPA, a purchase and sale agreement is concluded between a power generation company and a power buyer for electricity generated from renewable energy sources such as solar and wind power. This agreement enables power buyers to access renewable energy without owning solar power generation facilities themselves. On the other hand, a Virtual PPA focuses on trading the environmental value associated with electricity supplied by a renewable energy power plant. It is called a ”Virtual PPA” because no electricity is exchanged between the power generator and the purchaser. The “environmental benefit of lowering the global environmental impact” of electricity generated using methods that do not emit CO2 is granted to electricity purchasers in the form of a Non-FIT Non-Fossil Certificate (renewable energy designation).

How Virtual PPA Works

The mechanism of a Virtual PPA transaction is as follows:

Note: translated by Shizen Energy based on source from the Ministry of the Environment

(Source) オフサイトコーポレートPPAについて(環境省)p.9

- A contract is concluded between the power generation company and the power buyer regarding the price of renewable energy electricity and the terms of the environmental value transfer.

- The power generation company earns revenue by selling the electricity they generate to the market or to power companies.

- The power generation company and the power buyer adjust the difference between the contracted price and the market price in 2. Non-FIT Non-Fossil Certificates (renewable energy designation) from the relevant power plant will be transferred to the power buyer.

- The power buyer purchases electricity as usual from the power company.

Virtual PPAs involve the transfer of environmental certificates, allowing power buyers to continue purchasing their physical electricity through their existing arrangements.

What is the difference between a Virtual PPA and a Physical PPA?

PPAs are classified into two categories: Virtual PPAs and Physical PPAs. As explained above, a Virtual PPA is a transaction in which no actual electricity is purchased, and only the virtual concept of environmental value is exchanged. Because the market price of electricity fluctuates daily, the settlement amount that electricity buyers pay or receive under a Virtual PPA will also vary.

A Physical PPA, on the other hand, involves the trading of both actual electricity and environmental value. The contract period is generally between 5 and 20 years, and the price of electricity remains fixed for the electricity buyer even if market prices fluctuate during the contract period. The benefit for electricity buyers is that they can fix the purchase price of renewable energy electricity.

Benefits of companies using Virtual PPAs

What dvantages do Virtual PPAs offer businesses? Let’s delve into the key benefits.

There is no need to change the source of electricity

A Virtual PPA is a transaction that does not involve the supply of actual electricity; rather, it exchanges only the environmental value of renewable energy. This means that companies do not need to change electricity providers. By using the renewable energy electricity certificates obtained through trading, companies can reduce their electricity-related CO2 emissions.

Eliminates the need to own renewable energy generation facilities

Establishing on-site renewable energy power plants usually demands considerable initial capital. However, Virtual PPAs, and other PPA models, allow companies to obtain the environmental value of renewable energy at a predetermined contract price, thereby avoiding the need for large capital expenditures.

Enhances Stakeholder Engagement on Climate Action

Implementing a Virtual PPA powerfully showcases a company’s commitment to environmental stewardship. Increasingly, consumers are making purchasing decisions based on companies’ environmental initiatives. By implementing a Virtual PPA, businesses can effectively enhance their corporate image and brand reputation. Furthermore, this commitment is likely to result in a more favorable evaluation from investors, potentially driving increased ESG investment.

Challenges Associated with Virtual PPAs

While Virtual PPAs offer significant benefits for companies addressing environmental concerns, it’s important to be aware of certain challenges.

A potential risk associated with Virtual PPAs – increased financial burden on power buyers when electricity prices drop

Virtual PPAs involve a mechanism where the power buyer settles the difference between the market price and the contracted price to ensure stable revenue for the power generation company. While power generation companies have the advantage of being able to secure stable revenue through Virtual PPAs, on the other hand, if the market price of electricity falls, it is also conceivable that the compensation for the difference will become a one-sided burden on the power buyer. It has been pointed out that especially in regions where many solar power generation facilities are installed, an oversupply of electricity tends to occur, making it easy for the market price to fall. This means increased costs for power buyers and can become a disadvantage.

Potential Complexity in Accounting

The settlement mechanism in Virtual PPAs, where the power buyer pays or receives the difference between the market price and the contracted price, can lead to complex accounting procedures, potentially requiring specialized treatment beyond standard practices.

Initially, such transactions involving price differences based on market fluctuations might have necessitated registration or notification to the Financial Services Agency(FSA). However, in November 2022, the 24th Task Force for Comprehensive Review of Regulations Concerning Renewable Energy, etc., by the Cabinet Office, concluded that Virtual PPAs are not derivative transactions. While this clarifies that FSA notification is not required, the complexity of accounting for these agreements persists, making it essential for companies to consult with experts such as tax accountants when implementing Virtual PPAs.

Case study of Virtual PPA

A growing number of organizations are leveraging Virtual PPAs to achieve their carbon-neutrality goals. Below we will introduce a virtual PPA case in Japan.

Microsoft Corporation

Microsoft Corporation has signed a Virtual PPA agreement with Shizen Energy Inc. for the Inuyama Solar Power Plant located in Inuyama City, Aichi Prefecture. The agreement entails receiving the environmental values for a 20-year period from this large-scale solar power plant built by Shizen Energy. This is Microsoft’s first PPA in Japan and was one of the largest corporate PPA-backed solar power plants in the country at the time of financial close. This is expected to significantly contribute to Microsoft’s efforts to achieve ‘100% renewable energy by 2025’.

Summary

Virtual PPAs offer a strategic pathway for companies to acquire renewable energy certificates and demonstrate their commitment to sustainability. Beyond their contribution to the environment, Virtual PPAs are expected to bring benefits such as enhanced brand value and improved investor recognition anticipated that Virtual PPAs will continue to become widely adopted in Japan moving forward. While keeping a close watch on future trends, we encourage you to certainly consider introducing this system within your own company.

| 【reference】 All reference materials are in Japanese. |